Are you thinking of buying an Amazon FBA business? If so, it’s important to do your homework first.

In this blog post, we will discuss some of the things you should consider before becoming a new owner and seller. We’ll cover what Amazon FBA is, why someone would want to buy an existing FBA business, benefits and potential drawbacks, plus some key questions a potential buyer should ask before investing in one.

Basic Terms and Concepts to Know

Before we get into the nitty-gritty of important details, let’s be sure we have all the basics covered. If you’re already experienced with buying an FBA business, you’re likely familiar with these already and can skip them.

What is an FBA business?

A Fulfillment by Amazon (FBA) online businesses sell products on Amazon but do not directly handle shipping and returns. Unlike Fulfillment by Merchant (FBM) sellers, Amazon FBA sellers send their inventory to an Amazon warehouse where they are shipped to customers upon ordering.

This setup can help make selling and running an online business more profitable. However, the convenience of these services comes with related storage fees – knowing how this affects net profits per month is important before you buy.

What types of Amazon businesses are there?

Besides the FBA vs. FBM differentiation listed above, there are a few different ways to categorize different Amazon businesses. First is by their account type:

Individual Seller Account: No account fees, but a $0.99 fee per item sold. This account is typically best for new sellers and those that resell unwanted items on Amazon Marketplace, and Individual Accounts lack a lot of necessary tools for selling at large volumes.

Professional Seller Account: $39.99 fee per month, with no fees per item sold. The fee gives sellers access to various tools and reports that help with inventory management, and they’re most beneficial for a medium or large-scale store with high sales volumes.

However, Amazon businesses can also be categorized by what they’re selling:

Retail Arbitrage: You’ll see these sellers in the “New & Used from” section because they’re reselling products and leveraging small price differences for profit rather than truly having their own brand or product.

Though it’s common on Marketplace and can generate lots of revenue, this category is also rife with misinformation and false promises. There are many claiming to sell courses on how to teach new owners retail arbitrage. Many will claim to see massive profits with minimal effort when in reality, few are actually successful.

Wholesale: These Amazon sellers buy products in bulk to sell at a profit, usually from suppliers or from a vendor.

Wholesale selling on Amazon can deliver consistent results and profit but also heavy competition. There are nearly always multiple other sellers on the market competing for reviews, rankings, and sales, making it difficult to become a best seller. Wholesale Amazon sellers may also need to follow more strict rules on how to operate (e.g., what they write on their listings) depending on their distributor or vendor.

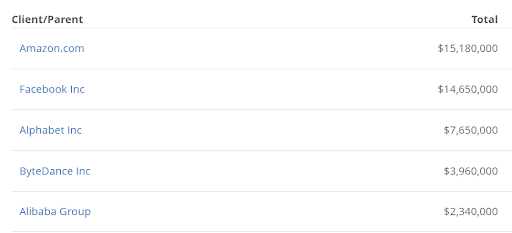

Private Label: This practice involves taking a generic product (typically from platforms like Alibaba), slapping a brand name sticker on it, and selling it as a unique product. This is why you will often find eerily similar-looking products in search results despite all of them technically being a different business. Additionally, though it’s not always the case, private label products have a reputation for being cheap in both price and quality.

A business on Amazon can manufacture and sell its own unique products. Generally speaking, however, when you buy a business that already exists it is one of the three types above. Why? Because if not, you’d be talking about buying an entire business that likely has its own website or off-platform sales, and your role as the owner would be more akin to buying a large enterprise.

Why Should I Buy an Amazon FBA Business Instead of Starting My Own?

There are many cases in which starting your own Amazon FBA business from scratch may be your best bet. However, many prefer to buy an existing FBA business because…well, it already exists.

Most Amazon business owners do not see success – it is a fiercely competitive environment, and it can be extremely difficult and time-consuming to stand out in search results.

Starting out from scratch means you’ll need to gather the ratings, reviews, and search rankings necessary to generate serious profits. Established FBA brands have already made it past that difficult phase and proven their viability (though that doesn’t mean the sales will continue – we’ll get to that later).

Consider These Points Before Buying an Amazon FBA Business

Perhaps someone selling their successful Amazon store came to you personally, or you have become interested in the idea on your own. Before getting into the details of what factors about the seller and business you should consider, you need to be sure that an FBA business is the right move for you.

After all, you could buy a perfectly profitable account and later find that the process isn’t like selling as a regular online store – a common case for many empire flippers with eCommerce experience. Additionally, the time and effort involved to keep the account profitable might not fit your schedule or be worth the price for you personally.

1) Avoiding the high-risk startup phase =! avoiding a high-risk investment.

Just because a business passed the difficult starting phase and generates a solid net profit does not mean it’s in the clear thereafter.

There are additional risks more specific to the platform as well: different types of account hijackers, listing sabotage, price wars, and other malicious practices from bad actors in your competitive environment are always around the corner. It can take days or weeks to address such concerns, and there are no safety nets for loss in sales you may have experienced in that period of time.

Lastly, there are a lot of variables that can be hidden to make a seller account look healthy and like a good investment at first glance. Buying an Amazon business requires a lot of due diligence and should be treated like purchasing any other company – we’ll cover what you need to know and ask before you buy an Amazon store later.

2) Just because you won’t have startup costs doesn’t mean you won’t have additional costs.

You’re likely going to need a bit of cash to get started that’s not related to buying the account. FBA selling often requires large initial investments in inventory, advertising, and some buffer cash as you get the hang of your regular operations.

3) Steady income =! passive income.

A lot of people – especially those aforementioned gurus – like to say that having an Amazon business is akin to passive income or a side hustle. This is technically possible, but extremely unlikely.

Many people starting from scratch are surprised when they discover just how much time is required to keep things going, or get high up enough in search results to see serious growth. In fact, it’s a big reason why many sellers don’t make it past one year even if their business was generating some profit.

You should consider how much time you’re also willing to invest in the brand you purchase in addition to your monetary investments. Factor this in when determining whether you’d be a good fit as the new owner. If you think that you may need to hire extra help (e.g. an Amazon advertising agency) in order to reduce the time you personally put into your store, keep in mind the money you’ll need for this too.

4) No two FBA businesses are completely alike.

You could have two stores selling related products in the same categories, and you’ll still have two completely different stores to consider at the end of the day. Behind the scenes, there are so many factors and strategies that go into selling. Some do better than others despite seemingly identical verticals. For this reason, it’s important you deeply research the business, its customers, and its category before making any final decisions.

Answers to Common Questions About Buying an Amazon FBA Business

Where can I find Amazon FBA businesses for sale?

In most cases, they are sold through brokers. A good site to start with is BizBuySell. It compiles most offers from around the internet onto one place, which makes for easy browsing and discovery. A keyword search can help you filter offers for Amazon FBA businesses specifically. Inversely, if you’re hoping to sell an Amazon FBA business, this is a good place to list it.

How can I verify that an FBA business for sale is legitimate?

It can be very difficult to verify the validity of an online business for sale, which can make the investment feel very risky, even for experienced empire flippers.

We will get into some questions to ask and tips to help ensure that you have the right information when looking at an offer. However, hiring a third party like Centurica to conduct Due Diligence services may be worth the extra money.

How much capital should I start with if I want to buy an FBA business?

Generally speaking, it will cost anywhere from 2-4 times the business’s annual EBITA (earnings before interest, taxes, and amortization) to purchase an eCommerce business. As mentioned earlier, it’s best to also have additional money reserves enough to cover initial inventory purchases and in most cases, a marketing budget.

The exact number depends on the size, account health, and profitability of the store you’re intending to purchase. If you want to play it safe, consider adding on the sum of operational costs (including inventory) for at least 1 month in addition to the capital you will use to purchase the business. Additionally, factor in the money needed for any legal or consulting services to help with the purchase and transfer process.

What to Look For When Buying an Amazon FBA Business: Conducting Due Diligence

Here are some points you should consider when looking through Amazon stores:

Account Health

One of the first things you want to look at is the health of the Amazon seller account. This will include factors such as how many products are listed, average sales volume, ratings and reviews, and feedback from customers.

An important and often overlooked area is the rate of returns for products. An otherwise successful, high-ranking account can end up taking huge profit losses due to returns. In addition to returns, be sure to look out for these smaller account health details:

- Order cancellation rates

- Late shipment rates

- Order defect rates

- Inventory performance index

Don’t be afraid to dive deep into customer feedback, and really take the time to read reviews. Doing so can ensure you pass up offers inflated by fake or bought reviews, which could not only result in an overvalued business but also could run the risk of you getting penalized due to platform rules later on.

Additionally, getting a good idea of poor reviews can help you determine your ability to fix any potential issues. For example, if the majority of bad ratings and reviews outline rude or lack of vendor response to order issues, this is something easily fixable on your end as you would now have direct control over it. However, if defects in products are the main concern, this could be a larger supplier issue that would require more effort and potentially capital to address.

Category

The second thing you’ll want to consider is what categories the business sells in. This will help you determine the amount of competition you may be dealing with in its marketplace, which plays a huge role in later investments like on-platform DSP advertising or off-platform marketing.

You should also consider the account’s positioning within its marketplace. This can help determine whether significant changes or investments will need to be made in updating product offers, optimizing listings, or expanding the business into new products and categories.

Lastly, take the time to determine whether you think there is still plenty of room for business growth within the category and specifically from the FBA account’s position. Some categories can be highly saturated, which would make an emerging seller’s likelihood of success much lower. On the other hand, some FBA accounts may have positioned themselves in lucrative niche markets full of potential.

Accounting Records

We’ll also include profit and loss statements as well as total fees from the platform here, which will give you a solid idea of what the Amazon seller account is worth, net profit, and so on. The past 12 months of operation are the most important for you when calculating value and determining whether the store is profitable.

Checking accounting records will also help you ensure that the FBA account was set up properly and the seller has kept accurate historical records throughout its operation.

Supplier Information and Records

One of the benefits of buying an established store is that you inherit a supplier network. However, this also comes with potential risks if the suppliers are not reliable or have inconsistent contact and communication.

The due diligence process should include verifying supplier information as well as checking to see if there are any records of late shipments, returns, or other issues with suppliers.

For Wholesale Accounts:

This is important to consider if you’re buying an FBA business with the intention of expanding it into retail channels. Distributor relationships and agreements can be a great asset that you acquire as part of purchasing an FBA account, but they may also require an investment on your part to maintain.

Review the terms of any distributor agreements and be sure that you will be able to continue supplying products through those channels if you choose to do so in the future. If you intend to seek out new supplier agreements, be sure to read the fine print of any existing contracts to avoid any legal setbacks that could arise from clauses that define minimum time periods or competing suppliers.

Questions to Ask Before You Buy an Amazon Store

Now that we’ve covered the basics to consider and information to look through about buying a business, here are some questions you should have answers to before making any official agreements or transfers.

In most cases, a seller will have answered these questions before you even ask them, but double-check this list to be sure all bases are covered:

Why is this Seller Central Account for sale?

You want to be sure you have all the details of why the FBA seller decided to put their store up for sale. Not only do you need to know any potential hurdles the seller encounter that made their venture no longer worth it (if any), but it’s also a great way to gauge how honest and straightforward a seller is with you.

Not all FBA stores that owners sell have issues impacting their profitability. Even in the case they do, there’s a chance your position and/or capital as an empire flipper could make it easier for you to promote growth to make it a perfectly profitable business, even if they couldn’t.

In the case that a seller isn’t completely honest about their FBA business for sale or its value, doing proper due diligence and going through the points mentioned above will ensure you catch this before it’s too late.

What are your lead times?

Lead times are important for e-commerce enterprises that source inventory. It’s not possible to sell inventory you don’t have. Therefore, you want lead times from suppliers to deliver your inventory to be short. The quicker your inventory moves, the shorter your lead times should be.

If lead times seem to be long enough to impact sales, this may be a supplier issue that will force you to buy larger volumes at a time or even seek out new suppliers with better results.

Many store owners have experienced longer lead times across the board due to supply chain issues in the past year, especially for that source product from China or elsewhere overseas. This should be factored in when considering supplier-seller relationships and their overall reliability, but could still require you to seek a new supplier regardless.

What is your current marketing strategy?

Nearly all sellers need some sort of Amazon advertising strategy in order to compete well within their category. In fact, many experienced sellers believe it’s not possible to grow a successful FBA business without using Amazon ads.

The most important things for you to know are whether the seller has a well-thought-out strategy and whether they are using Amazon PPC ads exclusively or if they have other social media accounts/affiliate marketing avenues.

Marketing off-platform and via Amazon DSP advertising has become more important for sellers to succeed in recent years, so what the seller already has established will determine how much money you’ll need to either expand or maintain its marketing strategy.

Conclusion

Buying an FBA store is a great opportunity for those who want to enter the e-commerce industry but don’t want to make a seller central account from scratch. If you’re interested in buying a business, be sure to do your due diligence. If you’re not sure where to start, you can use these main points and questions to start the due diligence process yourself. There are also services you can use to assist with this process.

Remember that in addition to accounting records as well as category and customer research, other commonly overlooked factors like the previous seller’s marketing strategy or supplier lead times can play a large role in how valuable the business is long-term.

Not familiar with Amazon advertising strategy? Check out our article on the different types of Amazon sponsored ads, and subscribe to our newsletter below for news and tips on your favorite digital platforms every week!